27 Nov Wheeling-Pittsburgh Corporation and Esmark Incorporated Stockholders Approve Combination

For Immediate Release

Combination to be completed on November 27, 2007, and Esmark Incorporated (ESMK) To Begin Trading On NASDAQ November 28th

PITTSBURGH, PA., November 27, 2007 – Esmark Incorporated and Wheeling-Pittsburgh Corporation today announced that the stockholders of Wheeling-Pittsburgh and the stockholders of Esmark Incorporated each have overwhelmingly approved the combination of the two companies. The combined company will conduct business under the name Esmark Incorporated, and its common stock will begin trading on NASDAQ under the ticker symbol “ESMK” effective November 28, 2007.

James P. Bouchard, Chairman and Chief Executive Officer of the newly formed holding company, Esmark Incorporated, said that the new company combines the strengths of Wheeling-Pittsburgh Corporation’s steelmaking assets with Esmark’s network of steel service centers across the Midwest, creating a stronger, well-capitalized company that can now singularly serve the production and distribution requirements of a unified customer base.

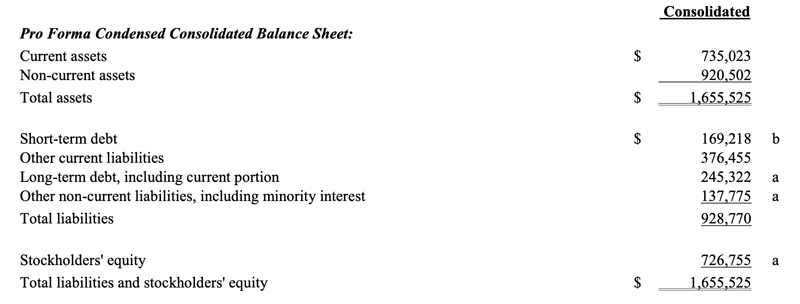

Based on the projected opening consolidated balance sheet for the combined entities, shareholder equity will now exceed $726 million, with a dramatically improved debt-to-equity ratio of .57 compared to a consolidated 1.97 as of September 30, 2007 and a total consolidated borrowing availability of approximately $167 million.

“Today marks a long-awaited milestone for stockholders, the employees of Wheeling-Pittsburgh Steel and Esmark, our partners at the United Steelworkers and the hard-working people of the Ohio Valley. It’s been a challenging year for all involved in combining our two companies, and I want to personally thank each and every individual who contributed to making this new company a reality. With this task now accomplished, we must combine the advantages of this new organizational structure with the cost initiatives recently enacted at Wheeling-Pittsburgh to generate strong, recurring profits. Equipped with a much improved balance sheet and enhanced liquidity position resulting from this merger, we are poised to do just that. It is a pleasure to lead our new company with a stronger balance sheet and without a going concern qualification,” said Bouchard.

Wheeling-Pittsburgh Corporation also announced the following results regarding the stockholder elections:

- Approximately 11.5 million of the 15.5 million shares outstanding voted, of which more than 93% voted in favor of the combination;

- Approximately 39.3 million Wheeling-Pittsburgh Corporation shares voted in favor of the combination;

- 575,654 shares have been exercised by stockholders in the purchase rights; and

- put right exercises will be prorated by allowing those stockholders that exercised put rights to put 98.49% of their election.

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements by the Company regarding its expected financial position, revenues, cash flow and other operating results, business strategy, financing plans, forecasted trends related to the markets in which it operates, and similar matters are forward-looking statements. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties include, among others, factors relating to: (1) the risk that the businesses of Esmark and Wheeling-Pittsburgh will not be integrated successfully or such integration may be more difficult, time-consuming or costly than expected; (2) the ability of the Company to realize the expected benefits from the proposed combination, including expected operating efficiencies, synergies, cost savings and increased productivity, and the timing of realization of any such expected benefits; (3) lower than expected operating results for the Company; (4) the risk of unexpected consequences resulting from the combination; and (5) certain other risks identified in the Company’s registration statement on Form S-4, and other reports and filings with the SEC. In addition, any forward-looking statements represent the Company’s views only as of today and should not be relied upon as representing the Company’s views as of any subsequent date. While the Company may elect to update forward-looking statements from time to time, the Company specifically disclaims any obligation to do so.

Media Contact: Bill Keegan, Edelman, 312.240.2624 (office) or 312.927.8424 (mobile), bill.keegan@edelman.com

Investor Relations Contact: Dennis Halpin, 304-234-2421 (office) or 304.650.6474 (mobile), halpindp@wpsc.com

###

Esmark Incorporated

Unaudited Profoma Condensed Consolidated Balance

Sheet and Liquidity and Capital Resources

November 27, 2007

(in thousands)

Notes:

The unaudited pro-forma condensed balance sheet is based on a preliminary application of purchase accounting principles, including an assumed purchase price per share of $20 and is subject to further review and adjustments

a. Assumes conversion of Wheeling-Pittsburgh convertible debt of $68 million and exchange of Esmark Incorporated temporary equity for common stock of the new publicly traded company, Esmark Incorporated.

b. Assumes net proceeds from purchase rights and put rights of $125 million, net of transactions costs of $8 million.